Headlinenews.news |

Public Policy Clarification.

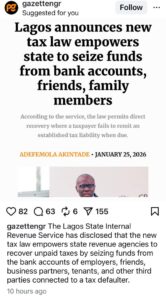

Reports suggesting that tax authorities can now freely withdraw money from citizens’ bank accounts — or even from the accounts of family members — have triggered widespread anxiety.

The concern is understandable, but the interpretation being circulated is often inaccurate.

Under Section 60 of the Nigeria Tax Administration Act, 2025, tax authorities are granted what is known as the “Power of Substitution.”

This provision allows government revenue agencies to recover unpaid tax debts by directing third parties holding funds on behalf of a tax debtor to remit such funds to the authorities.

This may include:

Banks holding the taxpayer’s funds.

Employers processing salary payments.

Tenants paying rent to a landlord who owes tax.

Businesses or clients owing money to the taxpayer.

However, it is important to state clearly: tax authorities cannot deduct money arbitrarily.

This is not a blanket licence to raid accounts at will.

For the substitution power to apply, two key conditions must exist:

The taxpayer’s liability must be properly assessed and legally established

The targeted funds must truly belong to the taxpayer or be owed to the taxpayer.

This means government cannot simply debit your mother’s or brother’s account because you owe tax, unless they are holding funds that are legally yours.

Although enforcement may appear sudden, the law is designed to prevent deliberate evasion — particularly where individuals attempt to shield taxable income through intermediaries or unpaid obligations.

The provision applies nationwide, meaning both federal and state tax agencies can adopt similar recovery mechanisms, subject to due process and legal safeguards.

Legal Remedies: Can Citizens Challenge Wrongful Tax Deductions?

Yes. Although tax authorities have lawful powers to recover confirmed tax debts, citizens and businesses can challenge wrongful deductions in court.

Legal action is most likely to succeed where the tax liability was not properly assessed or legally established, since Section 60 applies to confirmed debts, not mere allegations.

Courts may also intervene if due process was breached, such as failure to serve valid demand notices or observe statutory timelines.

One of the strongest grounds is wrongful targeting.

If deductions are made from a third party’s account that does not hold funds belonging to the taxpayer, courts can order reversal and refunds. Challenges may also succeed where amounts deducted exceed the actual liability or penalties were imposed unlawfully.

While tax agencies often act quickly, injunctions can be granted in clear cases of abuse or error. Prompt legal and professional advice is essential.

FAQs

Can tax authorities take money from my bank account?

Yes, but only after your tax debt is formally established.

Can they deduct money from my family’s account?

No — unless that account holds funds legally belonging to you.

Is this an arbitrary seizure power?

No. It must follow proper legal procedure and remains open to challenge.

What should taxpayers do?

Regularise obligations early and consult tax professionals if uncertain.

Headlinenews.news.