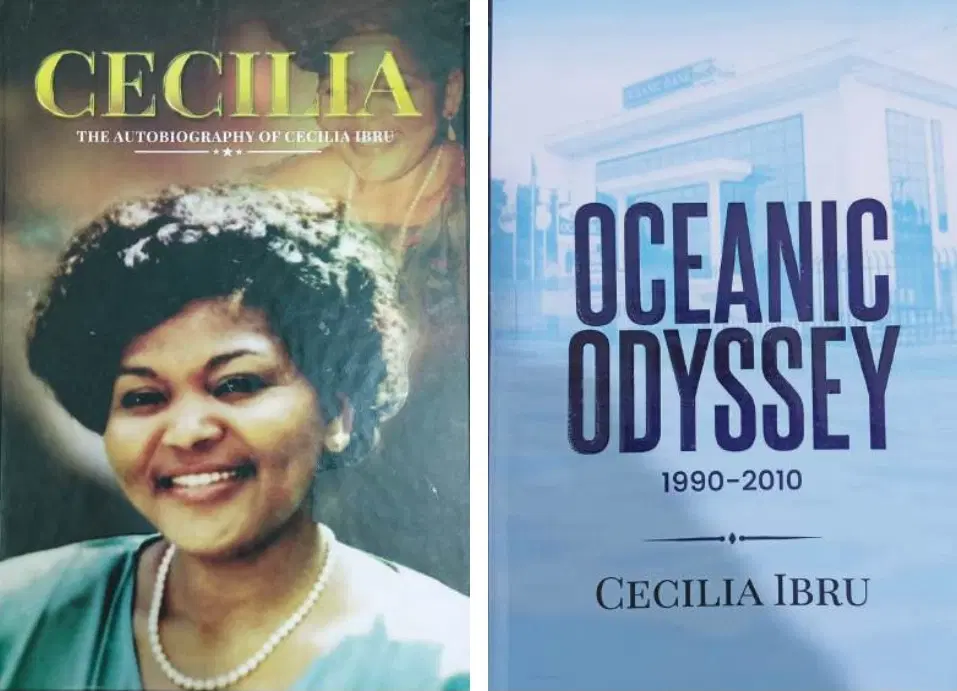

By Cecilia Ibru

Yesterday, I shared how General Ibrahim Babangida granted me a banking license, leading to the birth of Oceanic Bank. Today, I recount how the actions of a Central Bank Governor, under the administration of President Umaru Musa Yar’Adua, brought down Oceanic Bank and landed me in prison.

A New Era, A Sudden Storm

The appointment of a new Governor at the Central Bank of Nigeria (CBN) marked the beginning of turbulent times in the banking sector. Under the guise of financial reforms, this Governor launched an aggressive crackdown, accusing top executives of mismanagement and malfeasance. Many of us became targets in what quickly turned into a purge.

Any hope that successive administrations would re-evaluate these harsh actions quickly faded. The pattern was clear: appointees from previous regimes would only remain in office if they weren’t seen as a threat.

Personal Crisis and a Dire Warning

At the time, I was in the United States with my husband, who was battling Parkinson’s disease. Amid our personal challenges, I received a disturbing call from Dr. Erastus Akingbola, Managing Director of Intercontinental Bank.

“The CBN is coming for our banks,” he warned. “You need to come back immediately.”

Shocked and torn between my husband’s health and the fate of my life’s work, I called my eldest daughter to take over his care and booked a flight to Nigeria.

Seeking Help in High Places

Upon returning, I tried to reach President Yar’Adua, only to learn he had traveled to Germany for medical treatment. I then turned to Vice President Goodluck Jonathan, who referred me to the Attorney General, Mohammed Adoke—a man I believed would be sympathetic due to his past ties with Oceanic Bank.

What followed shook me to my core.

In our meeting, Adoke gave me a chilling reminder of government power. He asked, “Who killed Jesus?” When I remained silent, he answered, “The government.” His message was clear: the state could destroy anyone it chose. He warned me not to seek the President’s intervention again.

Doors Close, Silence Falls

Desperate, I tried every avenue. Calls to Erastus went unanswered. Efforts to reach the First Lady, Turai Yar’Adua, failed. When I visited Aso Rock—once a place I was warmly received—I was ignored and turned away. My name was mysteriously missing from the visitor list.

Frustrated, I headed to the CBN headquarters to meet the Governor directly, only to be blocked at every level. Even personal contacts within the CBN refused to see me.

One acquaintance who knew the Governor explained bluntly: “He believes you and Akingbola wanted his job. I told him, ‘You are the governor now, not her. Leave her alone.'”

She advised me to speak with Alhaji Umaru Abdul Mutallab, Chairman of First Bank. Though troubled, he received me kindly and simply said:

“Pray to God to take absolute control of your situation.”

The Storm Hits

As Managing Director, I had just submitted Oceanic Bank’s 2008 audited financials, which the Governor approved. We were preparing to present them at our AGM in Tinapa, Calabar. Oceanic Bank was one of 25 banks participating in a custodial arrangement where each had access to $1 billion in foreign reserves to bolster international credit lines—ours was with Commerzbank, Germany, supporting a $6 billion import facility for petroleum products.

Then came the ambush.

All bank MDs and Chairmen were summoned to a meeting at the old CBN building in Lagos. As we waited, whispers spread that the Governor was instead holding a world press conference. Our fears were confirmed when, live on air, he declared Nigerian banks “toxic,” effectively isolating us from global financial networks.

A Financial Earthquake

Foreign partners—banks with trading lines, letters of credit, and other instruments—suspended all dealings with Nigerian banks. The fallout was swift and catastrophic.

Traditionally, struggling banks were privately engaged by the CBN, given a window to rectify issues. If necessary, changes were made in consultation with the Board. This time, none of that happened. No courtesy. No collaboration. Just public execution.

It wasn’t reform—it was a hostile takeover. The procedure was reminiscent of a military coup.

After the press conference, the CBN Board met at the Lagos headquarters. Some banks were sent back to their offices. Others were told to expect another review. A few, like Oceanic, were asked to stay behind—for reasons we were yet to understand.

But for many of us, it was already over.