By HeadlineNews.News Editorial Desk

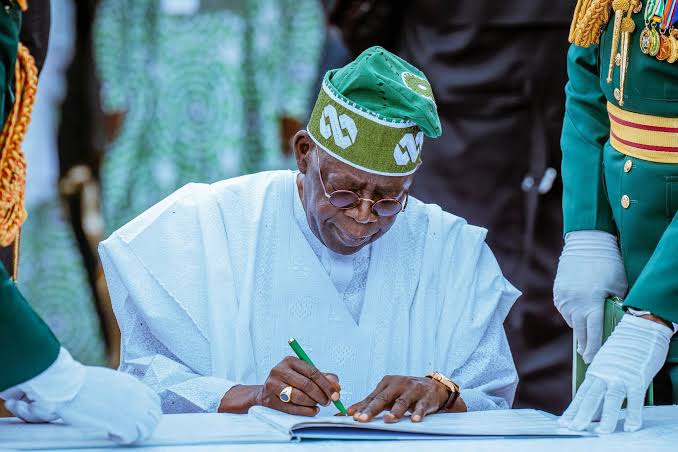

In a decisive move to simplify Nigeria’s tax system and ease financial burdens on citizens, President Bola Ahmed Tinubu has signed four new tax reform bills into law. These laws form part of the broader efforts under the Renewed Hope Agenda to enhance ease of doing business, widen the tax net through fairness—not force—and digitize tax administration nationwide.

But how do these new laws affect everyday Nigerians?

From side hustlers to salary earners, remote workers, and retirees, these tax reforms signal a shift in favor of the struggling majority.

Below, Dr. G. Fraser MFR breaks down the implications in plain, practical English—for you, not your tax lawyer.

1. Small Businesses Get Big Relief

If your business earns ₦50 million or less in a year, you’re now exempt from Company Income Tax (CIT).

This is a significant leap from the previous threshold of ₦25 million.

Whether you run a POS kiosk, fashion line, foodstuff store, or online biz, the government is saying: “Focus on growth, not tax.”

This reform alone is expected to benefit over 65% of Nigeria’s registered MSMEs, helping them reinvest earnings into operations and employment.

2. Salary Earners Take Home More

Workers earning ₦83,000/month (₦1 million/year) or less will now be completely exempt from Pay-As-You-Earn (PAYE) tax.

This is the first time in decades such a bold tax break is given to Nigeria’s low-income earners.

For higher earners—up to ₦1.7 million/month—new personal reliefs and allowances have been introduced. This means less PAYE tax, and more disposable income.

“It’s a move that puts dignity back into Nigerian labour,” said tax analyst Mr. Chuka Okafor. “Especially during inflationary hardship.”

3. Severance Benefits Are Protected

For those who recently retired, were laid off, or received termination packages, the first ₦50 million of your gratuity or severance pay is now 100% tax-free.

This provision is a safety cushion to protect the dignity of Nigerians during career transitions—particularly in today’s turbulent job market.

4. Families Are Protected from VAT

The government has expanded the list of VAT-exempt items, including:

- Basic food items

- Baby products

- School fees

- Electricity

- Hospital services

This directly impacts low-income families, shielding them from the burden of rising prices.

“The government must never profit from a child’s school fees or an emergency hospital visit,” noted Dr. Gloria Adebajo-Fraser, MFR, governance expert and perception management strategist.

5. Remote Workers Must Declare Income

If you’re a freelancer or remote worker earning in dollars from clients abroad, this new law now requires you to register with your state tax authority, declare your income in naira, and pay appropriate taxes like other Nigerians.

Digital platforms such as Payoneer, Wise, or Barter, once seen as invisible to local authorities, are now trackable through BVN-linked accounts and international tax treaties.

Nigeria has joined a global tax transparency movement, enabling countries to share income data on cross-border workers.

6. Simpler, More Transparent Tax System on the Way

To replace the often confusing and harassing multi-agency tax regime, the federal government is introducing:

- A Nigeria Revenue Service (NRS) to replace the Federal Inland Revenue Service (FIRS)

- A new Joint Tax Board, streamlining federal and state tax operations

- Tax Appeal Tribunal and Tax Ombudsman for justice, redress, and transparency

All reforms are aimed at reducing multiple taxation, improving taxpayer education, and ensuring a fairer, technology-driven tax process.

When Will All This Take Effect?

These reforms will take full effect in 2026, giving businesses, workers, and tax authorities enough time to adapt, prepare, and comply.

In Summary: What Nigerians Must Know

✅ Small businesses with less than ₦50m revenue: No CIT

✅ Low-income workers earning ₦83k/month or less: No PAYE

✅ Severance packages up to ₦50m: Tax-free

✅ Families: No VAT on basic needs

✅ Remote workers: Must now declare and pay state tax

✅ Simpler tax system: New NRS, joint board, digital structure

✅ Redress system: Ombudsman and Appeal Tribunal now available

“A good tax system must not only collect — it must care,” President Tinubu stated during a policy review session in April 2025. “These reforms aim to make tax an instrument of justice, not oppression.”

With Nigeria’s inflation rate still above 22%, these reforms may offer some breathing room for households and businesses alike — but only if properly implemented and widely understood.

For now, the message from Abuja is clear: Taxation must no longer be a trap — but a tool for shared prosperity.

© 2025 HeadlineNews.News. All Rights Reserved.