The Federal Inland Revenue Service (FIRS) has rejected former Vice-President Atiku Abubakar’s recent allegations regarding the selection of Xpress Payments Solutions Limited as a channel for the Treasury Single Account (TSA) revenue collection.

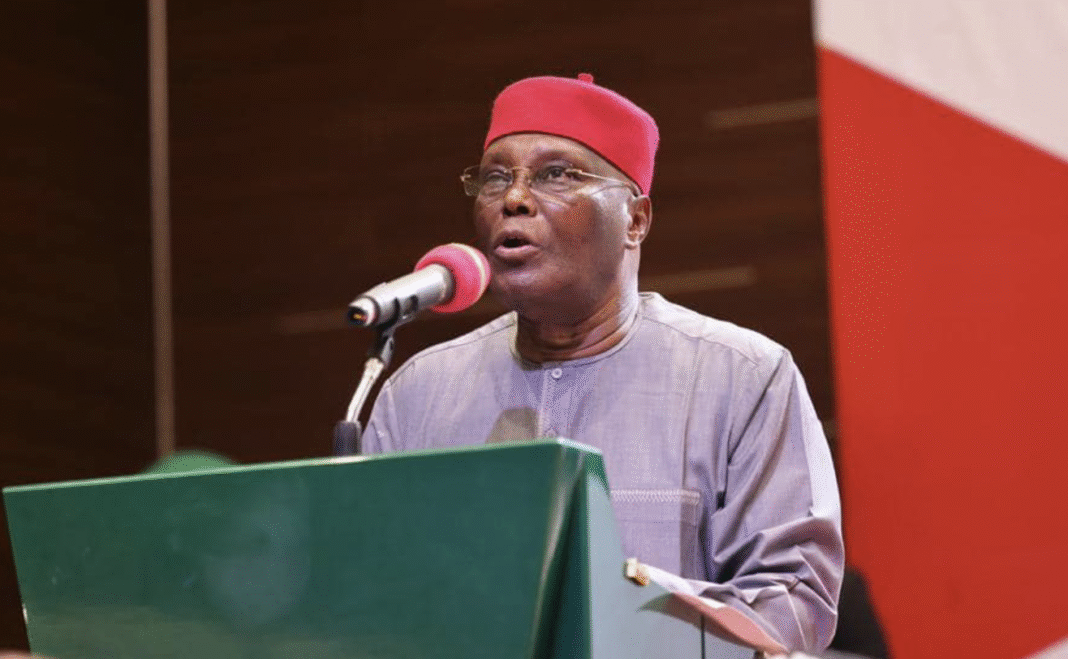

In a social media post on Sunday, Abubakar criticised the federal government for what he called the “quiet appointment” of XpressPay as a TSA collecting agent.

He described the move as a “dangerous revival of the Alpha Beta revenue cartel” that previously dominated Lagos State, warning that the initiative could turn Nigeria “from a republic into a private holding controlled by a small group of vested interests.”

The remarks came four days after the FIRS announced the appointment of XpressPay.

Responding on Sunday, Aderonke Atoyebi, technical assistant on broadcast media to the FIRS chairman, dismissed Abubakar’s claims as “incorrect, misleading, and an unnecessary politicisation of a purely administrative and technical matter.”

Atoyebi clarified that the FIRS does not operate any exclusive or single-gateway revenue collection system, and no private company has been given control over government funds.

“The agency currently employs a multi-channel, multi-payment solution provider (PSSP) framework, which includes platforms such as Quickteller, Remita, Etranzact, Flutterwave, and XpressPay,” she explained.

According to the official, the PSSPs are part of a transparent, competitive ecosystem designed to simplify tax payments for Nigerians. She emphasised that these providers are not collection agents and do not receive fees or percentages from government revenues.

“All funds collected via these channels are deposited directly into the Federation Account, without intermediaries or private control,” Atoyebi added.

She also highlighted that the TSA framework aims to enhance efficiency, support job creation, and ensure a transparent onboarding process for payment platforms.

The ongoing national tax reform, led by the presidential committee on fiscal policy and tax reforms, is described as a key step in Nigeria’s economic modernisation, grounded in transparency, efficiency, and wide stakeholder engagement.

“We urge political figures, including Mr. Atiku Abubakar, not to misrepresent routine administrative processes for political purposes. Nigeria’s tax system is too important for misinformation or unnecessary alarm,” Atoyebi said.

The FIRS reaffirmed its commitment to professionalism, transparency, and strengthening national revenue systems for the benefit of all Nigerians.