The final decision on the full implementation of Nigeria’s new tax laws, set for January 1, 2026, was confirmed yesterday.

President Bola Ahmed Tinubu reaffirmed that the scheduled date is firm and non-negotiable. His declaration, issued in a statement, endorsed earlier remarks by Minister of Information and National Orientation Mohammed Idris, who had stressed that the takeoff would proceed as planned.

The announcement comes after House of Representatives member Abdussamad Dasuki (PDP, Sokoto) raised concerns that the gazetted version of the tax laws differs from the copies passed by the National Assembly. This observation triggered renewed calls by opposition parties and interest groups to suspend the implementation.

However, Taiwo Oyedele, chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, argued that it was too late to halt the process, noting that two of the four tax laws are already in effect, while the remaining two are scheduled to commence tomorrow.

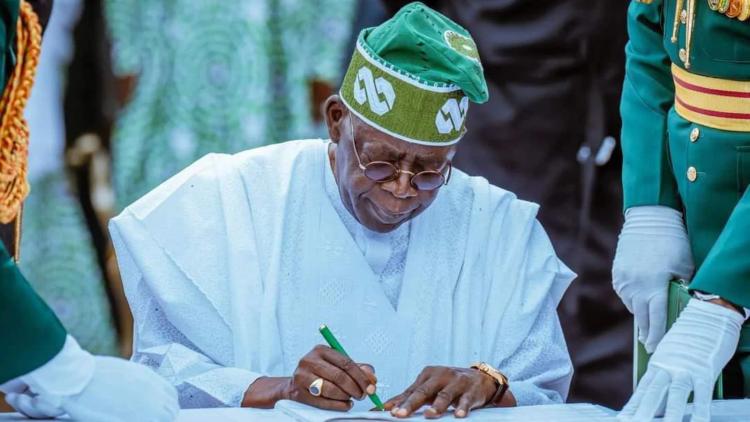

President Tinubu described the reforms as a historic restructuring of Nigeria’s fiscal system, emphasizing that they are not intended to increase taxes on citizens. In a statement personally signed by him, he said the tax reforms represent “a once-in-a-generation opportunity to build a fair, competitive and robust fiscal foundation for Nigeria.”

He added that the implementation would move forward despite ongoing public debate. “The new tax laws, including those that took effect on June 26, 2025, and the remaining acts scheduled for January 1, 2026, will continue as planned,” Tinubu said.

The President stressed that the reforms aim to harmonize the country’s fragmented tax system, reduce duplication between levels of government, and strengthen trust between citizens and the state, rather than simply raising revenue. He urged all stakeholders—including state governments, businesses, labor unions, and professional bodies—to support the rollout of the reforms.

Opposition Concerns

The Peoples Democratic Party (PDP) disagreed, calling on the President to suspend the laws and “listen to the voice of Nigerians.” The Turaki-led faction accused the administration of prioritizing revenue over citizens’ welfare, citing allegedly “dangerous provisions” inserted into the laws.

“The insistence on a January 1 start date despite unresolved discrepancies clearly shows where the government’s priorities lie—between Nigerians and money,” the PDP statement said.

Background on the Tax Reform Process

Since assuming office, President Tinubu has sought a comprehensive overhaul of Nigeria’s tax system. He established a presidential committee to develop new legislation following consultations across the country. Four bills were forwarded to the National Assembly, generating opposition from northern leaders and governors who opposed the reforms.

Despite advice from the National Economic Council to withdraw the bills for further consultations, the President maintained the process, allowing stakeholders to present their views during public hearings. The bills were eventually passed: the House of Representatives on March 18 and the Senate on May 7, with the President signing them into law on May 26. Two of the laws took effect in June, with the remaining two scheduled for January 1.

Opposition resurfaced after allegations arose that the gazetted versions of the laws differed from those passed by lawmakers.

Support from NECA

The Nigeria Employers’ Consultative Association (NECA) voiced support for the implementation of the tax laws. Speaking at a press briefing in Lagos, NECA Director-General Wale Smatt-Oyerinde praised the presidential committee for engaging stakeholders despite efforts to spread misinformation.

He urged the Federal Inland Revenue Service (FIRS) to collaborate with the private sector to raise awareness about the reforms. According to Smatt-Oyerinde, the tax legislation is a critical step toward creating a more consistent and productive business environment, which could generate employment and address underlying causes of insecurity in Nigeria.

He acknowledged the public debates and allegations over differences between the gazetted and parliamentary versions but stressed that the issues do not warrant halting the reforms. “No law is perfect, which is why provisions for amendments exist. Implementation allows us to build stronger institutions,” he said.

Smatt-Oyerinde concluded by urging that the tax legislation be allowed to proceed seamlessly, emphasizing that its success is crucial for Nigeria’s economic growth.