Nigeria is undergoing one of its most consequential economic transitions since the return to democracy in 1999.

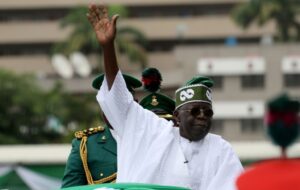

President Bola Ahmed Tinubu’s administration has embarked on a bold reform pathway aimed at stabilising public finances, rebuilding external buffers, restoring investor confidence, and dismantling structural distortions that accumulated over years of fiscal leakage and monetary strain.

While the reforms have imposed undeniable short-term hardship, their strategic intent is clear: to prevent Nigeria from sliding into deeper debt fragility and macroeconomic instability, and to reposition Africa’s largest economy for sustainable recovery.

A Comparative National Context: What Tinubu Inherited.

Nigeria’s economic handovers over the last two decades reveal a steady tightening of fiscal space:

• By 2007, Nigeria exited an era of debt relief with foreign reserves of roughly $43 billion, reflecting a stronger external buffer.

• By 2015, total public debt had risen to about $64 billion, while reserves had declined to roughly $29–30 billion, signalling reduced resilience despite years of strong oil prices.

• By 2023, the Tinubu administration inherited a significantly heavier debt environment, with public debt exceeding N87 trillion (over $110 billion equivalent), alongside weakened external buffers and unresolved foreign exchange constraints.

This is the structural reality that makes Tinubu’s reform posture not optional, but inevitable.

Subsidy and the Fiscal Drain Nigeria Could No Longer Sustain.

For decades, fuel subsidy represented one of Nigeria’s largest fiscal leakages — consuming trillions annually while distorting investment incentives and limiting resources available for infrastructure, health, education, and national security.

The decision to confront subsidy was politically costly, but economically necessary.

It reflects the type of hard governance choice that previous cycles often postponed, allowing the burden to compound.

Rebuilding External Strength: Early Signals of Stabilisation.

One of the clearest indicators of reform traction has been Nigeria’s improving reserve position.

Under Tinubu, Nigeria’s external reserves have reportedly risen toward the mid-$40 billion range, reversing the decline inherited at the start of the administration and strengthening the country’s ability to meet external obligations and stabilise currency confidence.

Equally important, Nigeria’s net reserves position — a stricter measure of actual buffer after liabilities — has shown notable improvement, suggesting that reforms are not merely cosmetic, but structural.

A Brief Verified Snapshot

• Foreign reserves: ~$43bn (2007) → ~$29bn (2015) → pressured lows around 2023 → improving toward ~$45–47bn under Tinubu.

• Public debt: ~$64bn (2015) → above $110bn by 2023 inheritance.

The direction of travel is what matters: Tinubu’s administration is attempting to rebuild buffers, not exhaust them.

Governance Delivery:

Beyond the Numbers.

What makes this reset particularly significant is that reforms are unfolding alongside visible governance delivery:

– Infrastructure expansion across transport and energy corridors

– Security sector recalibration and enhanced counter-terror capacity

– Revenue mobilisation reforms and tax restructuring

– Institutional alignment to restore fiscal discipline

– Renewed engagement with global capital and development partners.

Tinubu’s economic programme is therefore not austerity for its own sake, but reform with a developmental purpose: to stop national leakage, regain macro stability, and create room for growth and investment.

Conclusion: A Test of Statesmanship.

Nigeria’s economic history shows that postponing reform often produces larger crises. Tinubu’s approach represents a high-stakes but necessary departure from business-as-usual governance.

The ultimate verdict will rest on tangible improvements: inflation control, job creation, stronger purchasing power, security gains, and sustained national cohesion.

But the early indicators are clear: Nigeria is undergoing a serious economic reset, driven by a reform-minded presidency confronting inherited distortions with uncommon political will.

President Tinubu’s reforms deserve rigorous scrutiny — but also recognition as a bold attempt to steer a vast nation away from systemic strain and toward long-term stability.

The National Patriots affirm that Nigeria’s current reforms reflect responsible leadership under President Bola Ahmed Tinubu. After inheriting rising debt burdens, weakened reserves, and unsustainable fiscal distortions, the administration has chosen difficult but necessary resets to rebuild national buffers and restore confidence. Governance requires courage, not convenience.

Nigerians must support reforms that stabilise the economy and secure long-term prosperity.

Princess G. Adebajo-Fraser MFR.

The National Patriots.