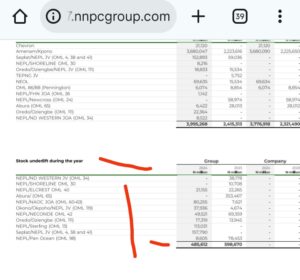

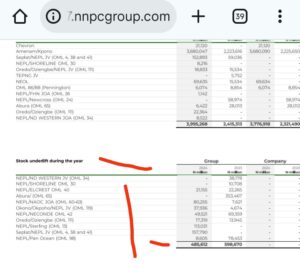

A review of the Nigerian National Petroleum Company Limited (NNPC Ltd.) financial statements by SaharaReporters has revealed that crude oil valued at N485.6 billion was not lifted during the 2024 financial year.

The report highlights unlifted crude across several joint ventures and oil mining leases (OMLs) as follows:

-

NEPL/ELCREST OML 40: N21.1 billion

-

NEPL/NAOC JOA (OML 60–63): N80.2 billion

-

Okono/Okpoho/NEPL JV (OML 119): N37.9 billion

-

NEPL/NECONDE OML 42: N49.5 billion

-

Oredo/Oziengbe (OML 111): N17.3 billion

-

NEPL/Sterling OML 13: N113 billion

-

Seplat/NEPL JV (OML 4, 38, 41): N157.7 billion

-

NEPL/Pan Ocean (OML 98): N8.6 billion

Earlier, SaharaReporters noted that Nigeria failed to meet its crude oil production quota set by OPEC, according to the cartel’s latest monthly report.

The figures show an average daily production of 1.401 million barrels, falling short of the OPEC quota of 1.5 million barrels per day. Production in the third quarter of 2025 averaged 1.444 million barrels daily, declining from 1.48 million in Q2 and 1.46 million in Q1.

OPEC data also showed that Nigeria’s daily output was 1.39 million barrels in September 2025, down from 1.43 million in August and 1.50 million in July. Production in the preceding months varied between 1.40 million and 1.53 million barrels daily, with the country missing the OPEC quota in seven out of ten months from December 2024 to September 2025.

Industry analysts attribute the persistent shortfalls to pipeline vandalism, sabotage, and mismanagement, which continue to hinder the nation’s ability to fully exploit its production capacity. Experts have warned that continued underproduction could affect government revenue and economic growth.

Nigeria has also struggled to meet domestic refinery demand. According to the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), 67.66 million barrels of crude oil were supplied to local refineries between January and August 2025. This falls short of the projected 123.4 million barrels required for the same period, leaving a deficit of over 55.8 million barrels, or roughly 45% of domestic needs.

Eniola Akinkuotu, Head of Media and Strategic Communications at NUPRC, explained that the allocations were made in line with the Petroleum Industry Act (PIA) 2021 and the Domestic Crude Supply Obligation policy, noting that all refiners received their deliveries during the eight-month period.

Meanwhile, Nigeria’s reliance on imports remains high. Foreign trade statistics for the first half of 2025 show that the country imported fuel worth N4.13 trillion between January and June, reflecting ongoing challenges in bridging the domestic crude supply gap.