The Central Bank of Nigeria’s decision to raise Nigeria’s Monetary Policy Rate (MPR), also known as the interest rate, from 22.75 per cent to 24.75 per cent has drawn criticism from private sector operators who fear it will exacerbate inflation and result in widespread job losses. The Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture, and the Nigerian Association of Small Scale Industrialists voiced concerns that the hike in MPR would hinder the private sector’s access to affordable credit, potentially leading to adverse economic consequences. The Lagos Chamber of Commerce and Industry acknowledged the necessity of the MPR adjustment given the current economic conditions but highlighted the challenges it poses for businesses.

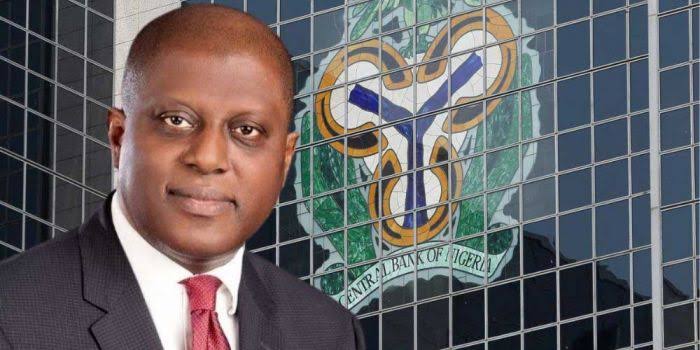

CBN Governor, Yemi Cardoso, announced the MPR increase after the second Monetary Policy Committee meeting for the year, emphasizing its focus on reducing inflationary pressures and ensuring exchange rate stability. Despite concerns about economic hardship, the decision to raise the MPR was unanimous among committee members, reflecting a commitment to combat inflation, which currently stands at 31.70 per cent.

The hike in MPR follows a significant increase in the previous meeting and adjustments to the asymmetric corridor around the MPR. Additionally, the Cash Reserve Requirement was raised to 45 per cent, while the Liquidity Ratio was maintained at 30 per cent. Cardoso noted the MPC’s awareness of rising food inflation and stressed the importance of restoring purchasing power and stabilizing the economy.

While recognizing the need for tight monetary policy in the face of inflationary pressures, private sector representatives expressed concerns about the negative impact on borrowing costs, production costs, and economic growth. They urged the CBN to adopt a more targeted approach that addresses liquidity issues without unduly burdening the private sector.

Experts caution that while tightening policy may help control inflation, it could also hinder investment and exacerbate unemployment. They stress the importance of balancing inflation concerns with growth considerations and suggest a more measured approach to monetary policy adjustments.

Critics argue that frequent rate hikes may be ineffective in addressing inflation and could instead impede productivity and economic growth. They emphasize the need for policies that incentivize investment and promote productivity to achieve sustainable economic stability.