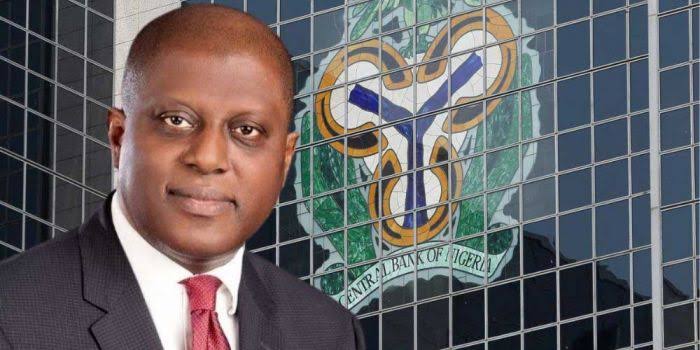

The Central Bank of Nigeria (CBN) intensified its efforts to combat inflation on Tuesday by raising its monetary policy rate (MPR) for the second consecutive month, this time by 200 basis points. The combined 600-basis-point increase in its key interest rate since February 27, bringing it to 24.75 percent, is expected to attract foreign investors to the country, analysts have noted. Last month, the apex bank raised the interest rate by 400 basis points to 22.75 percent. Olayemi Cardoso, the governor of the CBN, announced the further rate hike after the two-day Monetary Policy Committee (MPC) meeting in Abuja, attended by all 12 members of the committee.

The committee also raised the cash reserve ratio (CRR) of merchant banks from 10 percent to 14 percent, while retaining the CRR of commercial banks at 45.00 percent and holding the liquidity ratio constant at 30.00 percent. These decisions, Cardoso emphasized, underscore the CBN’s commitment to curbing inflation.

Analysts have welcomed the tightening measures, noting that Nigeria, along with Egypt, is demonstrating seriousness in tackling inflation. They believe that Nigeria is now attractive to foreign investors, which should help lower borrowing costs for the government. However, some concerns have been raised about the impact of the increased borrowing costs on economic growth and entrepreneurship. Critics argue that while fighting inflation is important, excessively high borrowing costs may stifle economic activity and hinder growth.

Despite the concerns, most analysts agree that the MPC’s decision to tighten its main policy rate reflects confidence in the CBN’s ability to address inflationary pressures. The extended hiatus in MPC meetings, spanning six months, suggests that this move may be interpreted as a necessary adjustment to align policy with prevailing economic conditions.

Overall, the CBN’s actions are aimed at achieving price stability and reducing inflation, even if it means compromising short-term economic growth. The focus is on bringing down inflation to the target level of 21 percent by the end of the year, even if it means issuing instruments with higher yields. The MPC is expected to continue implementing measures to absorb excess liquidity and maintain a hawkish stance in the face of rising inflationary pressures.