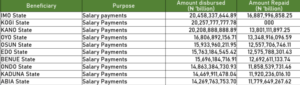

At least 31 state governments in Nigeria borrowed a total of N457.17 billion to cover salaries for their civil servants. This borrowing was made possible through the Salary Bailout Facility (SBF), a program initiated by the Central Bank of Nigeria (CBN). Here is a breakdown of the top 10 states that received the highest loan amounts:

10. Abia State

Securing the tenth position, Abia State received N14.27 billion for salary payments. Known for its commercial hub in Aba, famous for crafts and footwear, the state faced economic challenges necessitating this borrowing.

9. Kaduna State

Following closely, Kaduna State borrowed N14.47 billion. As a key industrial center in Northern Nigeria facing economic pressures and insecurity issues, the state sought financial assistance for salary obligations.

8. Ondo State

Renowned for its cocoa production and cultural heritage, Ondo State borrowed N14.86 billion, indicating a need to diversify revenue sources beyond federal allocations.

7. Benue State

Commonly referred to as the “Food Basket of the Nation,” Benue State requested N15.7 billion. Despite its agricultural strength, the state’s borrowing highlights fiscal strains in managing administrative duties.

6. Edo State

With a disbursement of N15.76 billion, Edo State ranks sixth on the list. Seeking financial intervention to meet governmental obligations, the state’s rich history and cultural significance are notable.

5. Osun State

Holdings the fifth spot with a loan amount of N15.93 billion, Osun State’s diverse economic activities, including tourism, required central borrowing for salary payments.

4. Oyo State

In fourth place, Oyo State received N16.81 billion. Despite being a populous state with the city of Ibadan at its core, the state turned to the CBN for fiscal support.

3. Kano State

Kano State, a major commercial and agricultural hub in Northern Nigeria, secured a loan of N20.21 billion. Reflecting a large civil service and the state’s commitment to stable government services, this substantial borrowing was necessary.

2. Kogi State

Just shy of the top spot, Kogi State borrowed N20.26 billion. Despite possessing natural resources, economic challenges prompted borrowing to cover salary expenses, making it the most expensive state to reside in Nigeria.

1. Imo State

Leading the list, Imo State borrowed the highest amount of N20.46 billion. Dependent on oil and agriculture, the state’s substantial public sector workforce and accumulated salary arrears warranted significant borrowing to meet payment obligations.